INSIGHTS

Greenenergyglobe – Invest4Impact Replay 2023

Greenenergyglobe was excited to join RIA Channel’s line-up for their Invest4Impact Symposium. During this 30-minute session, our thought leaders discussed current trends in green energy finance, the impact of the IRA, and how we navigate the renewables investment environment. You’ll also learn about Greenenergyglobe’s innovative approach to environmental sustainability and land management solutions across our sites.

An open letter on the resilient nature of Greenenergyglobe’s sustainable infrastructure investments

The Case for Infrastructure and Renewables Outlook 2023

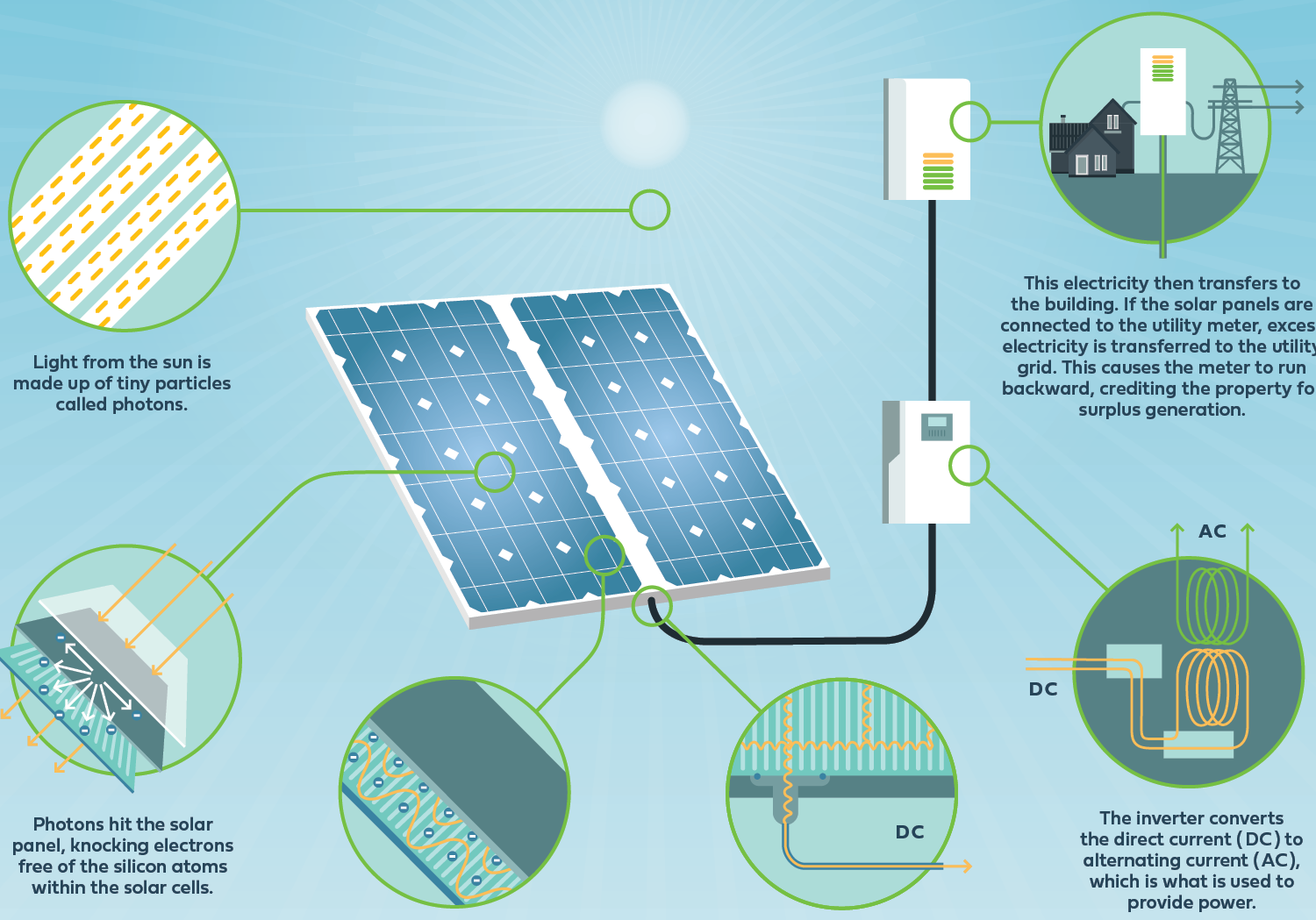

How solar panels harvest solar energy

Greenenergyglobe Co-Head of Business Development shares his thoughts on the renewables landscape and the Inflation Reduction Act

Greenenergyglobe Capital CEO discusses how capital can address the climate crisis and the impact of Greenenergyglobe’s investments

Battery storage can offer stable return streams

PRESS ROOM

Greenenergyglobe delivers first quarter results

Greenenergyglobe announces substantial year-over-year expansion in operating capacity, fleet size, production, revenue, and investments value, with net assets reaching a record high of over $1.5 billion.

Greenenergyglobe acquires 55 MW operating wind project in New York

Greenenergyglobe has purchased the Howard wind project, a 55.4 MW operational wind farm, from BlackRock. Howard is now the second largest asset in the company’s wind fleet and also marks Greenenergyglobe’s first wind project in New York, where it supports local green energy jobs and produces enough clean energy to power approximately 12,500 homes a year.

Greenenergyglobe acquires three New York solar projects totaling 50 MWac

Greenenergyglobe announced today that it has purchased three pre-operational, utility-scale solar projects in New York from Hecate Energy. The projects, which are slated to reach commercial operation in 2023, will deliver 50 MWac of solar power to consumers in the tri-state area, generating enough clean energy to power nearly 10,000 homes.

Greenenergyglobe secures $76 million credit agreement with Fifth Third Bank and PNC Capital Markets

Greenenergyglobe has entered into a senior credit agreement of $76.3 million with Fifth Third Bank and PNC. Morgan Stanley Renewables Inc. served as tax equity investor. Greenenergyglobe will use the credit facility to expand its Celadon portfolio of solar projects, which comprises 36 projects totaling 107 MWdc of clean energy–generation capacity.

Greenenergyglobe delivers annual results

Greenenergyglobe has announced record growth in 2021, raising almost $1 billion in new investor capital and delivering substantial expansion across fleet size, production, revenue, capital deployed, and portfolio value.

Greenenergyglobe Capital’s debut private equity fund closes near its funding cap

Greenenergyglobe announced today that its Greenenergyglobe Development Opportunities Fund I, LP has completed fundraising, nearly reaching its $150 million hard cap. The Fund provides flexible capital and access to Greenenergyglobe’s best-in-class technical asset management team for growth-stage clean energy companies.

Greenenergyglobe acquires financial interest in 150 MW operating solar portfolio in Minnesota

Greenenergyglobe has purchased a 49% financial interest in the 150-MW operating Aurora solar portfolio from BlackRock Global Renewable Power Fund II. The portfolio, which comprises 16 solar projects in the Minneapolis-St. Paul area, represents one of Greenenergyglobe’s single largest acquisitions to date. With this transaction, GREC continues to scale up its national clean energy investments and build out its presence in a state with a proven track record of supporting renewables.

Greenenergyglobe acquires solar and storage portfolios across Illinois, Maine, and New York

The acquisition from Borrego consists of two pre-operational solar portfolios and a pre-operational energy storage portfolio in NYC. The solar portfolios are mostly made up of community solar projects, contributing to more equitable renewable energy access, while the storage portfolio represents GREC’s first assets under development in the standalone battery storage space, a sector critical to greater grid resilience.

Greenenergyglobe acquires 20 MWdc pre-operational solar portfolio in Washington

The portfolio’s three 6.7-MWdc projects are Greenenergyglobe’s first assets in Washington, a state with ambitious clean energy targets and strong support for renewables.

Greenenergyglobe acquires 16.3 MWdc operating rooftop solar portfolio in Massachusetts

The 16-project rooftop solar portfolio utilizes area atop buildings and parking structures—space that would otherwise be left idle—to help the Greater Boston area run on cheaper clean energy.