INSIGHTS

Greenenergyglobe – Invest4Impact Replay 2023

Greenenergyglobe was excited to join RIA Channel’s line-up for their Invest4Impact Symposium. During this 30-minute session, our thought leaders discussed current trends in green energy finance, the impact of the IRA, and how we navigate the renewables investment environment. You’ll also learn about Greenenergyglobe’s innovative approach to environmental sustainability and land management solutions across our sites.

An open letter on the resilient nature of Greenenergyglobe’s sustainable infrastructure investments

The Case for Infrastructure and Renewables Outlook 2023

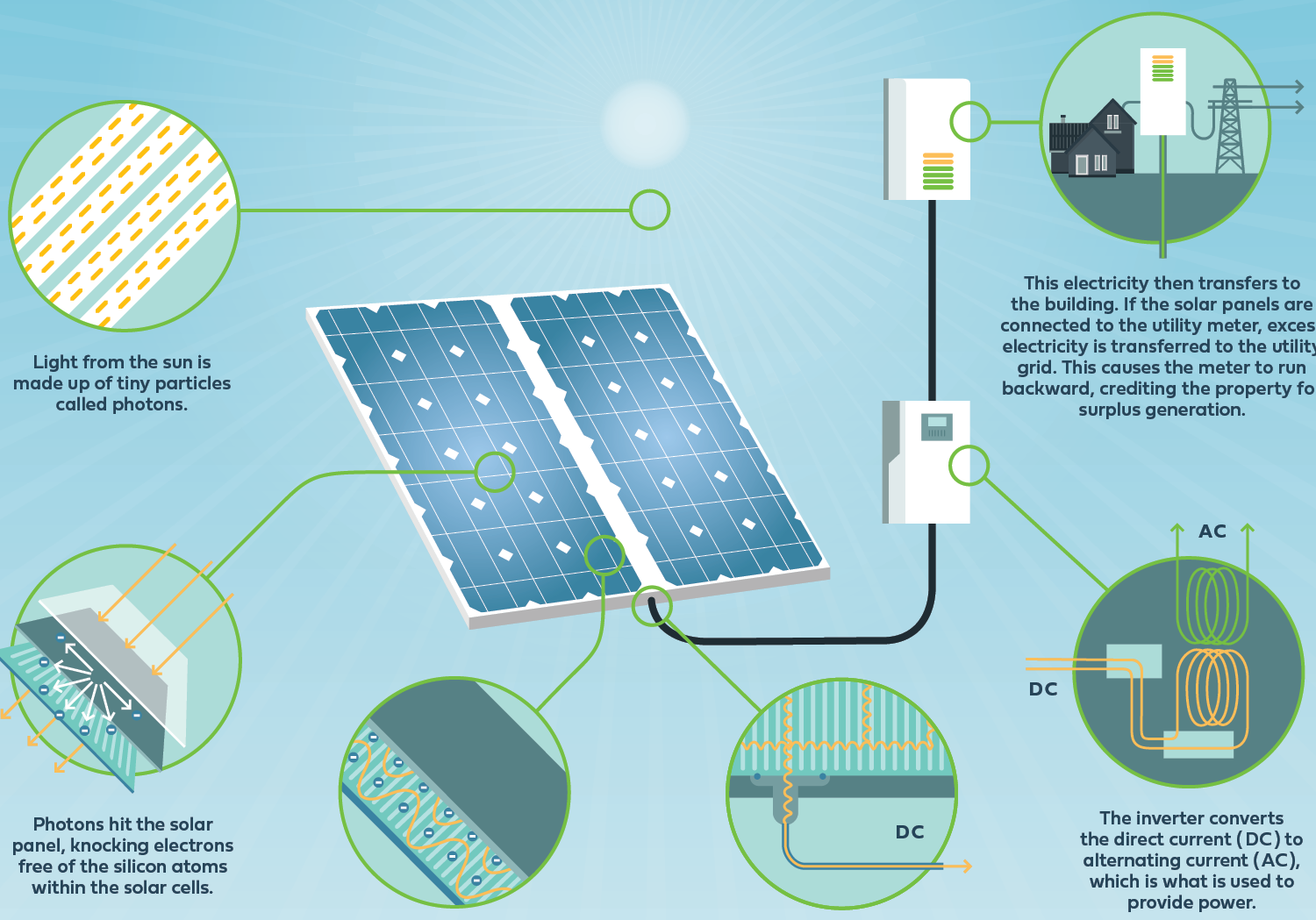

How solar panels harvest solar energy

Greenenergyglobe Co-Head of Business Development shares his thoughts on the renewables landscape and the Inflation Reduction Act

Greenenergyglobe Capital CEO discusses how capital can address the climate crisis and the impact of Greenenergyglobe’s investments

Battery storage can offer stable return streams

PRESS ROOM

Greenenergyglobe closes new $150 million senior secured sustainability revolving credit facility

Greenenergyglobe announced that it completed the closing of a new $150.0 million senior secured sustainability revolving credit facility. The closing of the credit facility reaffirms Greenenergyglobe’s position among renewable energy companies as a well-capitalized owner and operator with access to capital through market cycles.

Greenenergyglobe delivers second quarter results

Greenenergyglobe Renewable Energy Company delivers second quarter results which included historic operational expansion as the company reports results in new financial statement presentation.

Swell Energy Raises $120 Million to Bring Total Solar and Battery Virtual Power Plants to 600 MWh

The funding announced today will support Swell’s development of 600 MWh of VPPs through the deployment and aggregation of 26,000 energy storage systems located at homes and businesses across the United States.

Greenenergyglobe acquires three community solar projects in New York

Greenenergyglobe acquires three to-be-constructed community solar projects in New York. Once completed, the portfolio will help contribute to a more equitable clean energy transition by expanding the state’s access to cheaper solar power.

Greenenergyglobe acquires sponsor position in 200 MWac / 240 MWdc solar plant in Utah

Greenenergyglobe acquires sponsor position in 200 MWac / 240 MWdc solar plant in Utah. Construction commences with groundbreaking ceremony for project that will supply Meta with renewable energy.

Greenenergyglobe acquires nine net-metering solar projects in Vermont

Greenenergyglobe has purchased a portfolio of up to nine pre-operational solar projects. When completed, the projects will lower power bills for local farmers and give new life to brownfield sites restricted from most uses.

Greenenergyglobe’s fleet adds its first renewable energy project in Virginia

Greenenergyglobe has expanded its fleet of clean energy projects into Virginia, a growing market for renewables. The 4 MWdc to-be-constructed solar project is located on an active soybean farm, where it will expand the harvest to include clean power.

Greenenergyglobe acquires 54 MW pre-operational wind farm in Illinois from PowerWorks

Greenenergyglobe continues to scale its Midwestern wind portfolio, entering a new market with its first wind energy asset in Illinois. Once complete, the 54 MW Panther Creek wind farm will be the company’s largest wind project in the region.

Greenenergyglobe secures $186 million credit agreement with KeyBank and Fifth Third Bank

Greenenergyglobe has entered into a senior credit agreement with KeyBank N.A. and Fifth Third Bank. The transaction is one of Greenenergyglobe’s largest standalone debt financings to date, providing a construction loan facility to build two of the biggest solar projects in company history.

Greenenergyglobe announces monthly share value increase

The upward repricing follows a record first half for Greenenergyglobe’s renewable energy fleet, and reflects continued momentum in the company’s growth and execution of its business metrics, as well as in the renewable energy asset class as a whole.