GREC 2023 Annual Meeting of Shareholders

The GREC 2023 Annual Meeting of Shareholders, originally scheduled for May 31, 2023, was rescheduled to July 13, 2023 at 9:00 a.m. Eastern Time. You may register to attend the Meeting by clicking the “Vote Now!” button and entering your control number provided on the voting materials you received. If you cannot attend the meeting, we ask that you still place your vote by using the “Vote Now!” button on this page.

Greenenergyglobe Renewable Energy Company (GREC) is a publicly reporting, non-traded limited liability company that acquires and manages income-generating renewable energy and other energy-related businesses. Our business objective is to generate attractive risk-adjusted returns for our investors, consisting of both current income and long-term capital appreciation. We do this by acquiring and financing the construction and operation of income-generating renewable energy and sustainable development projects, primarily within North America. GREC invests in a diversified portfolio of income-producing renewable energy power facilities that sell long-term electricity contracts to off-takers with high credit quality, such as utilities, municipalities, and corporations.

PERFORMANCE OVERVIEW

Past performance is not indicative of future results. Return information is unaudited and subject to change. All returns shown assume reinvestment of distributions and are net of all expenses.

1 As of May 31, 2023. Inception to date (“ITD”) returns are annualized consistent with the IPA Practice Guideline 2018.

2 As of June 1, 2023. There is no assurance GREC will pay distributions in any particular amount, if at all. Any distributions will be at the discretion of the board of directors. GREC may fund distributions entirely from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, or offering proceeds. In no event, however, shall funds be advanced or borrowed for the purpose of distributions if the amount of such distributions would exceed the accrued and received revenues for the previous four quarters, less paid and accrued operating costs with respect to such revenues, and costs shall be made in accordance with generally accepted accounting principles, consistently applied. For the quarter ending March 31, 2023, 100% of distributions were funded from a return of principal, cash on hand and other financing sources. By funding distributions with a return of principal to investors, GREC will have less money to invest, which may lower its overall return. For a historical breakdown of the distribution funding sources, please see GREC’s SEC filings.

3 Monthly share value as of May 1, 2023. Monthly Share Value (MSV) based calculations involve significant professional judgment. The calculated value of our assets and liabilities may differ from our actual realizable value or future value, which would affect the MSV as well as any returns derived from MSV, and ultimately the value of your investment. See the Private Placement Memorandum (“PPM”) for additional details related to the calculation of MSV.

4 Returns shown reflect the percentage change in the MSV per share from the beginning of the applicable period, plus the amount of any distribution per share declared in the period. All returns are unaudited, assume the reinvestment of distributions, and are net of all expenses including G&A expenses, management fees, performance participation fees, and share class specific fees, as applicable.

PORTFOLIO STATISTICS

AS OF 3/31/23

3.4 GW

RATED SYSTEM CAPACITY¹

456

NUMBER OF ASSETS¹

35

STATES, PROVINCES, TERRITORIES, AND DISTRICTS

18.1 YEARS

WEIGHTED AVERAGE REMAINING TERM LENGTH²

268

OFFTAKERS WITH POWER PURCHASE AGREEMENTS (PPA)

92%

INVESTMENT-GRADE OFFTAKERS

Operational Growth Highlights

(Year Over Year)

AS OF 3/31/23

Fleet operating capacity increased by 24%

Fleet added 52 new assets, bringing the total project count to 456

For more details on our year-over-year highlights, please read our 1Q23 business update

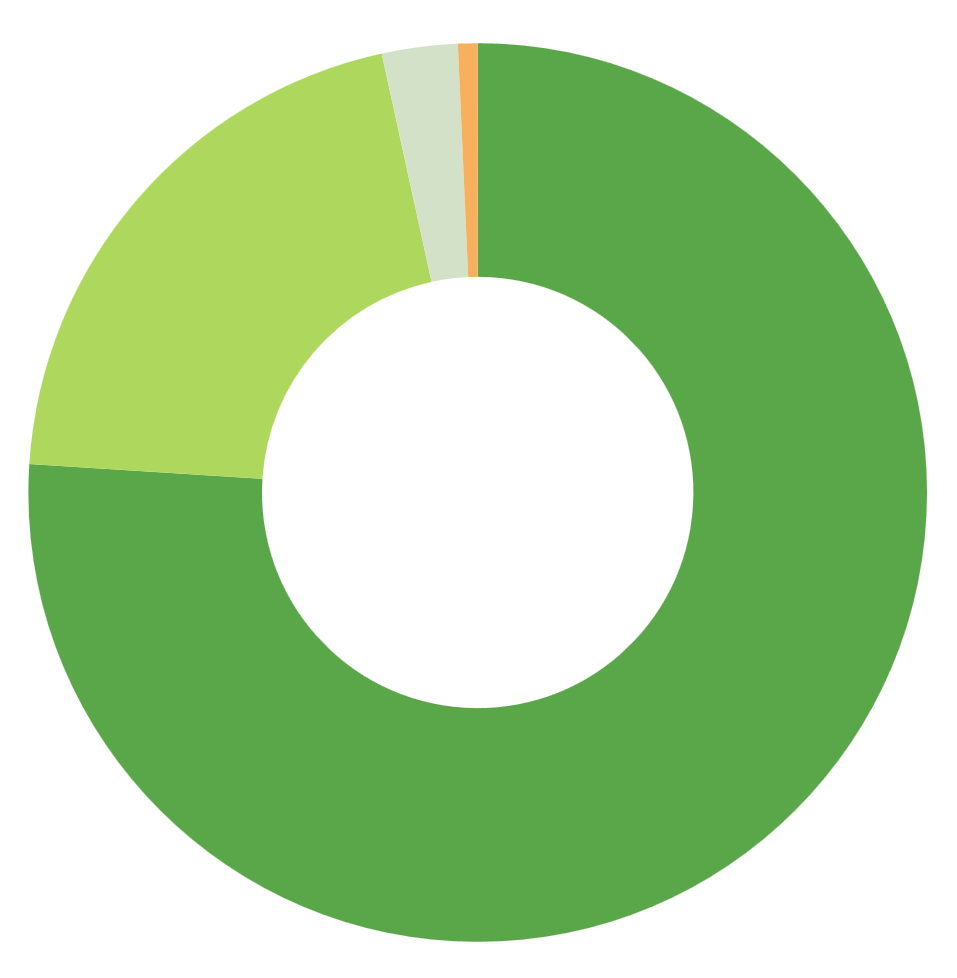

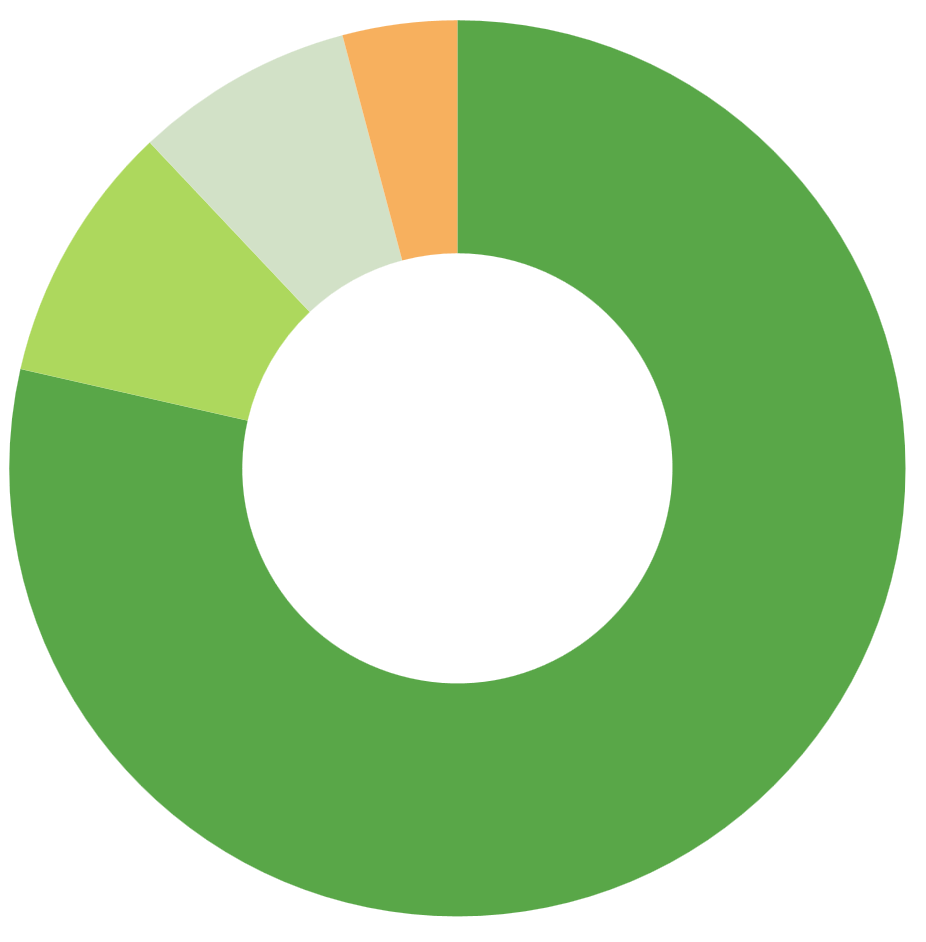

Total Pre-Operating Capacity

(% Capacity)

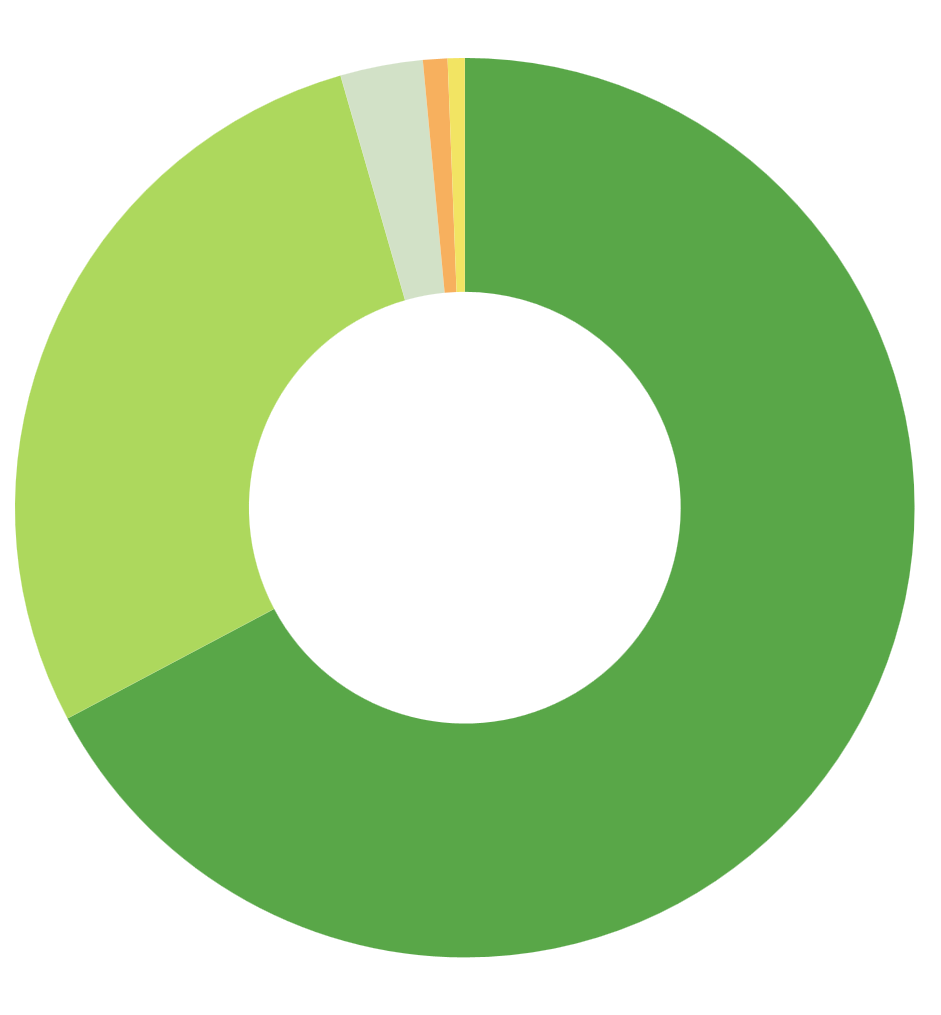

Total Operating Capacity

(% Capacity)

High-Credit-Quality Offtakers

(% Capacity)

Portfolio metrics are unaudited and subject to change.

1Prior to 3Q20 the Company did not formally track total asset and capacity statistics for projects the Company had contracted to acquire but had not yet closed.

2Weighted average remaining contract term refers to the power purchase agreements (“PPA”) of our total assets.

3Non-rated off-taers are unrated by credit rating agencies.

TEAM

ELLE BRUNSDALE

AVP

ARMAND DEHANEY

VP, INVESTMENTS

MIKE DUDUM

AVP

JACQUELINE FEDIDA

VP, INVESTMENTS

NEERAV JASHNANI

VP, INVESTMENTS

DONAL MAHONEY

AVP

SPENCER MASH

EVP, CHIEF FINANCIAL OFFICER | EXECUTIVE COMMITTEE

MEHUL MEHTA

CHIEF INVESTMENT OFFICER | EXECUTIVE COMMITTEE

BAILEY PLUMMER

PRINCIPAL, INVESTMENTS

BEN TILLAR

PRINCIPAL, INVESTMENTS

CHARLES WHEELER

CEO | EXECUTIVE COMMITTEE

DELLA XU

ASSOCIATE, INVESTMENTS

MANDY YANG

ASSOCIATE, INVESTMENTS

GREC Portfolio Activity

Greenenergyglobe acquires 6.5 MWdc pre-operational solar project in Vermont

The South Street solar project is now GREC’s largest solar asset in Vermont. Once completed, 100% of the clean energy it produces will be allocated to Middlebury College.

Greenenergyglobe’s 15.3 MW RoxWind asset reaches commercial operation

Greenenergyglobe’s largest sustainable infrastructure project in Maine powers 4,500 homes and supports local clean energy jobs.

Greenenergyglobe Delivers Third Quarter Results

The company shows significant quarter-over-quarter and year-over-year growth across revenue, production, and fleet size, as well as expanding land stewardship goals.

Greenenergyglobe acquires 6.6 MWdc pair of community solar projects in Maine

The projects—Athens Ridge (3.8 MWdc) and Mars Hill (2.8 MWdc)—deepen Greenenergyglobe’s relationship with ReneSola Power Holdings, a renewables developer with a robust pipeline of solar projects and battery energy storage systems. The two solar assets also diversify and expand Greenenergyglobe’s fleet of sustainable infrastructure assets in a state with high demand and policy support for renewable energy.

Investor Center

For account-related inquiries, contact our Transfer Agent at (833) 404-4104

For completed Greenenergyglobe paperwork:

Regular Mail

PO Box 219255

Kansas City, MO 64121-9255

Overnight Mail

430 W 7th St Ste 219255

Kansas City, MO 64105-1407