While markets have performed well so far in 2023, as of this writing, economists are calling for a volatile year in publicly traded markets with a high likelihood of slowdown or recession in the broader economy. Historically, infrastructure has performed well during such periods, due to its strong cash flows and inelastic demand.

Opportunity for steady income & hedge against inflation

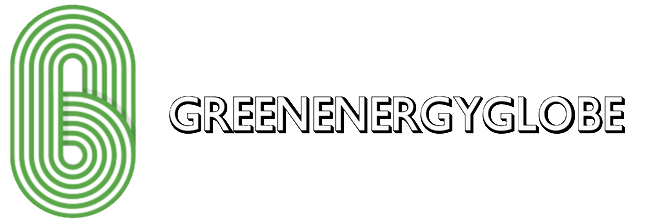

The infrastructure asset class tends to enjoy less exposure to market movements and inflationary pressure than other segments of the market, performing well during inflationary periods regardless of growth backdrop.

Infrastructure assets, such as power plants, are often funded via long-term contracts, which helps insulate them from the phases of the economic cycle. Because consumption of water, heat, and power don’t generally fluctuate significantly across the economic cycle, infrastructure investments can offer an opportunity for steady income across market environments.

In addition to providing essential services to communities through long-term contracts, infrastructure assets also tend to have Consumer Price Index-linked costs and prices, giving them a natural hedge against the effects of inflation.

Infrastructure’s historical average annualized performance amid high inflation

Policy catalysts

Infrastructure has delivered consistent returns throughout market cycles and, heading further into 2023, renewable infrastructure is set to benefit from historic policy tailwinds.

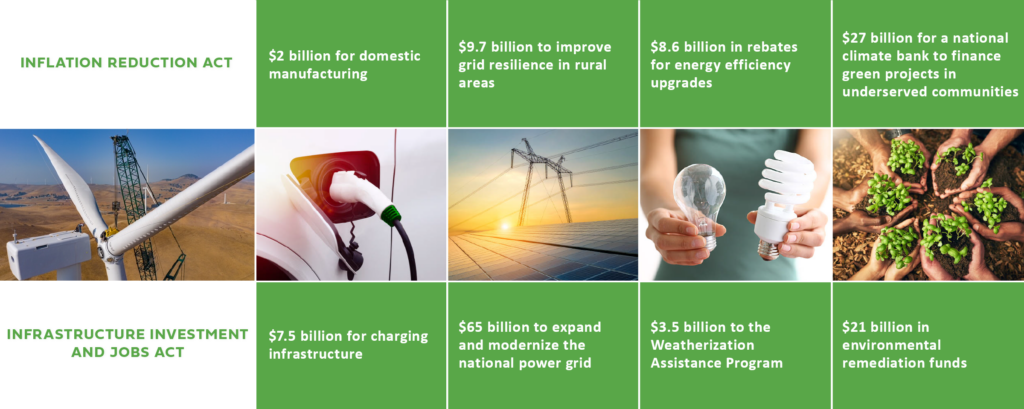

The Inflation Reduction Act (IRA) passed in August 2022 provides $369 billion to reduce greenhouse gas emissions, improve US energy security, and increase domestic investment, development, and employment in the clean energy sector. Although markets are awaiting guidance from the IRS regarding the exact implementation of certain IRA provisions, this landmark legislation—coupled with other recent policy support—makes it clear that the energy transition is a priority for the world’s largest economy.

Many of the IRA’s clean energy investments will work hand in hand with the Bipartisan Infrastructure Investment and Jobs Act, passed in late 2021, to spur sustainable infrastructure deployment. Among other areas, this includes support for electric vehicle charging infrastructure, modernization of the electric grid, and energy efficiency upgrades.

Moreover, 36 states and Washington, DC have established either renewable portfolio standards or renewable energy goals to drive the clean energy transition at the state level.1 For a dozen of those states, plus the nation’s capital, these targets include 100% clean power by 2050 or sooner.

Corporates are also increasingly setting clean energy targets for themselves. At least 60% of the Fortune 500—including 76% of the largest companies in the Fortune 100—have adopted one or more emission reduction, energy efficiency, renewable energy, or net-zero goals.2 Additionally, a number of the country’s largest utilities have voluntarily committed to net-zero carbon by 2050.3 4

Pickup in 2023

The lingering pandemic-related supply chain issues impacting the infrastructure asset class and renewable energy industry continued to improve in 2022. Greenenergyglobe and other market participants welcomed the US government’s two-year moratorium on solar tariffs—after a tariff petition put an unexpected pause on US solar development—as well as the administration’s invoking of the Defense Production Act to boost domestic solar panel production.

Even amid challenges, global infrastructure fundraising hit a record-high $148 billion across 59 infrastructure, renewable energy, and energy transition funds last year (topping the $103 billion raised in 2021).5 BloombergNEF recently reported that energy transition investments around the globe surpassed $1 trillion in 2022, of which the US accounted for $141 billion.6

From a power production perspective, although the US solar industry added less new capacity in 2022 than it did in the record-high 2021, those numbers are expected to increase steadily over the next few years. By 2027, it’s estimated that new solar installations in the US will be double what they were in 2021, amid an increasingly supportive market landscape for renewables.7

A confluence of powerful tailwinds

The infrastructure and renewable energy asset classes sit squarely at the intersection of energy resilience and the energy transition.

Investing in infrastructure and renewable assets during periods of market uncertainty can be a strategic move that offers investors the opportunity for both diversification and insulation from short-term volatility, while meeting growth objectives in the long term. These assets provide an essential service often funded by long-term contracts and can offer steady income with inflation-mitigating return characteristics.

The space is benefiting from a confluence of powerful tailwinds—a backdrop that investors seeking to diversify their alternative or fixed income alternative portfolios can capitalize on.

1 Renewable energy explained – Portfolio standards, US Energy Information Administration.

2 Power Forward 4.0: A progress report of the Fortune 500’s transition to a net-zero economy, World Wildlife Fund, June 2, 2021.

3 The 5 Biggest US Utilities Committing to Zero Carbon Emissions by 2050, Greentech Media, Jeff St. John, September 16, 2020.

4 Arizona Electric Utilities Voluntarily Commit to 100% Clean Energy, Arizona Corporation Commission.

5 2022 Fundraising Report: As another record falls, smaller LPs may join the fray, Inframation News, Pablo Martinez, January 24, 2023.

6 Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time, BloombergNEF, January 26, 2023.

7 After a Bumpy Year, Renewable Energy Looks Poised for Boom Times, Wall Street Journal, Dieter Holger, December 29, 2022.