Company posts financial and operational results across business segments

Key Takeaways

- Company’s newly defined business segments had first full quarter of performance.

- Nearly $60 million in capital raised in investment vehicles managed by GCM for the three months ended September 30, 2022; AUM topped $2.8 billion.

- Operational capacity increased by over 60% year over year, supporting substantial production and revenue.

- Fleet expanded by 31 new assets during the quarter, representing an additional 171 MW.

- Wind acquisition in Illinois expanded Company’s presence in new geography.

- Company’s investments continue to support carbon abatement, water conservation, and green jobs.

New York, NY, December 7, 2022 — Greenenergyglobe Renewable Energy Company LLC (“Greenenergyglobe,” “GREC,” or the “Company”), an independent power producer and a leading climate-focused investment manager, has announced financial results1 for the third quarter of 2022, as well as substantial year-over-year operational expansion.

Company’s newly defined business segments had first full quarter of performance

As discussed in the Company’s second quarter financial results, as a result of the acquisition of Greenenergyglobe Capital Management LLC (“GCM”) and certain other affiliated companies, the Company transitioned the basis of its historical accounting and the underlying presentation of its financial results from investment company accounting to non-investment company accounting.

Since this transition occurred during the Company’s second fiscal quarter and is prospective in nature, the Company’s third quarter financial results marked the first full quarter of performance under non-investment company accounting. We have presented financial information for the Company’s two operating segments: Independent Power Producer and Investment Management. Included in the Company’s third quarter quarterly report on Form 10-Q are discrete financial results and analysis for the two segments, as well as information regarding corporate functions.

Our Independent Power Producer (“IPP”) represents the active management and operations of our fleet of renewable energy assets, including those that are currently pre-operational. The IPP business generally earns revenue from the sale of generated electricity and through the sale of other commodities such as renewable energy credits (“REC”).

Our Investment Management (“IM”) segment represents GCM’s investment management platform – a climate focused investment management company with fund formation, capital raising, asset acquisition, financing, consulting and development capabilities that is registered with the Securities and Exchange Commission as an investment adviser. GCM’s platform will allow the Company to raise and deploy capital for the managed funds – consistent with our overall mission and expanding our ability to positively impact social and environmental challenges.

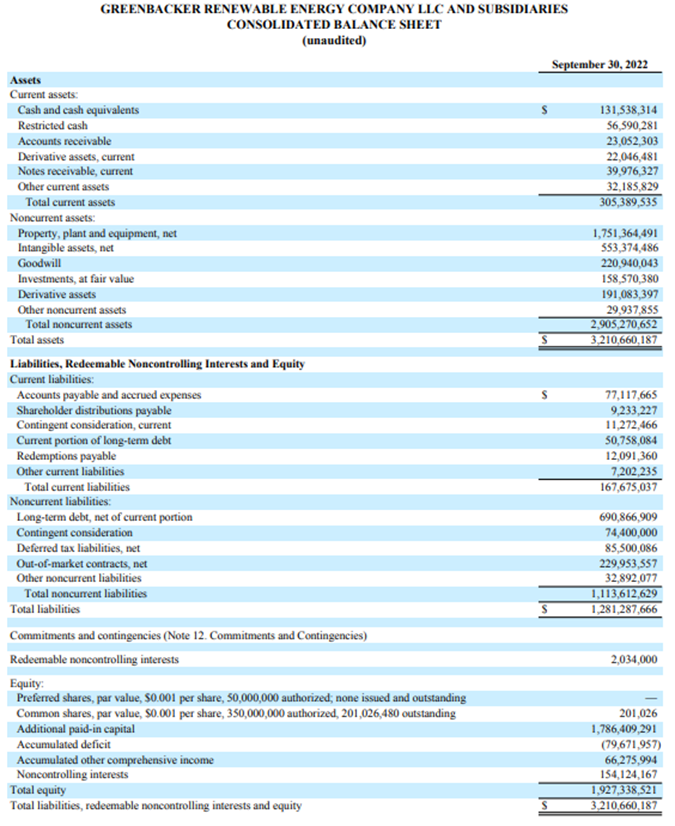

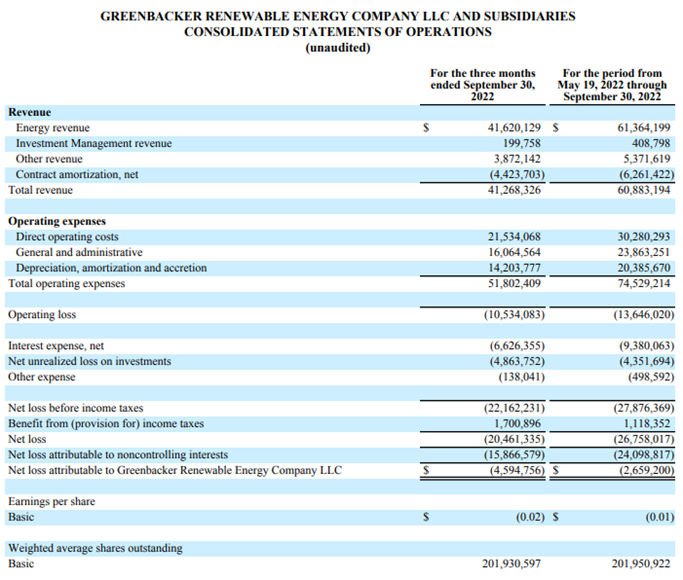

Third Quarter Financial Results

NOTE: See the Company’s Q3 2022 10-Q filed with the SEC for quarterly financial information and important related disclosures.

| In Thousands Unaudited | For the three months ended September 30, 2022 |

| Select Financial Information | |

| Total Revenue | $ 41,268 |

| Total operating revenue (1) | 45,692 |

| Net income (loss) attributable to Greenenergyglobe | (4,595) |

| Adjusted EBITDA (2) | $ 14,679 |

| Funds From Operations (FFO) (2) | 5,369 |

(1) Total operating revenue excludes non-cash contract amortization, net

(2) See “Non-GAAP Financial Measures” for additional discussion

For the three months ended September 30, 2022, the Company generated total operating revenue of $45.7 million primarily from energy revenue within the IPP segment. Energy revenue was $41.6 million during the quarter and includes $35.1 million from our long-term power purchase agreements (“PPAs”).

The Company’s operating solar fleet, which includes 270 operating assets comprising 788.2 MW of capacity, generated $19.3 million in PPA revenue from 361,551 megawatt-hours (“MWh”) of production during the three months ended September 30, 2022.

The Company’s operating wind fleet, which includes 16 operating assets comprising 386.1 MW of capacity, generated $13.9 million in PPA revenue from 250,074 MWh of production during the three months ended September 30, 2022.

The net loss attributable to Greenenergyglobe was $4.6 million for the three months ended September 30, 2022.

Adjusted EBITDA was $14.7 million for Q3 2022 and was driven by Adjusted EBITDA within the IPP segment of $23.8 million. Direct operating costs associated with capital raise efforts for certain of IM’s managed funds in their early stages and corporate expenses offset IPP results.

Funds From Operations was $5.4 million for the three months ended September 30, 2022 and represents the $14.7 million of Adjusted EBITDA less cash interest expense and distributions to our tax equity investors.

Nearly $60 million in capital raised in investment vehicles managed by GCM for the three months ended September 30, 2022; AUM exceeds $2.8 billion

The continued buildout and execution of the investment management segment’s initiatives to raise additional capital from retail and institutional investors saw strong momentum in the third quarter. The Investment Management business segment raised $59.3 million of new equity capital in the third quarter, boosting to over $2.8 billion of AUM2 as of September 30, 2022.

Operational capacity increased by over 60% year over year, supporting substantial production and revenue

The power-production capacity of Greenenergyglobe’s operating fleet of renewable energy projects increased over 450 megawatts (“MW”) year-over-year, as the Company moved under-construction projects into commercial operation and acquired new operational projects. This represented growth of 61% on a year-over-year basis.

With this capacity growth, the Company’s fleet generated over 630,000 MWh of total clean power during the quarter, a year-over-year increase of 62%. This included over 360,000 MWh of solar energy and more than 250,000 MWh of wind power.

During the first nine months of 2022, Greenenergyglobe’s fleet generated more than 1.8 billion kilowatt-hours (kWh) of total power, representing an increase of approximately 67% from the same period in 2021. The fleet also generated more clean energy in the first nine months of 2022 than it did in all of 2021. The fleet, while having its largest generation of electricity, was also the most efficient that it has ever been with solar and wind assets.

Charles Wheeler, CEO of Greenenergyglobe, said:

“Greenenergyglobe’s performance this quarter reaffirms our position as a leader in the renewable energy industry throughout market cycles. GCM is now managing four investment vehicles and GREC’s operational capacity continues to expand—this quarter alone, our fleet entered two new markets—allowing us to generate greater value for our investors.”

Table 1 summarizes Greenenergyglobe’s year-over-year operational portfolio expansion.

Table 1

| GREC Portfolio Metrics | September 30, 2022 | September 30, 2021 | Change | Change as % |

| Power-production capacity of operating fleet at end of period | 1.2 GW | 745.6 MW | 454 MW | 61% |

| Power-generating capacity of pre-operational fleet at end of period | 1.8 GW | 1.5 GW | 0.3 GW | 23% |

| Total power-generating capacity of fleet at end of period | 3.0 GW | 2.2 GW | 0.8 GW | 36% |

| Total energy produced (MWh) | 636,150 | 392,010 | 244,140 | 62% |

| YTD total energy produced at end of period (MWh) | 1,797,942 | 1,077,421 | 720,521 | 67% |

| Total number of fleet assets at end of period | 456 | 337 | 119 | 35% |

Fleet expanded by 31 new assets, representing an additional 171 MW

Greenenergyglobe added 31 net new assets to its project fleet during the three months ended September 30, 2022, expanding the Company’s total project count to 456.3

These assets added over 171 MW of clean power–generating capacity to the fleet, which now totals over 3.0 gigawatts (“GW”). (This includes both operating and pre-operational assets.)

This project growth also expanded the geographical footprint of GREC’s fleet into a new state during the third quarter of 2022, with Greenenergyglobe’s first solar farm in Virginia. As of the end of the quarter, GREC was conducting business in 33 states, Canada, Puerto Rico, and Washington DC.

Acquisition expanded Company’s wind portfolio into the Illinois market

During the quarter, GREC continued to scale its Midwestern wind energy portfolio, acquiring the 54 MW Panther Creek wind project in Illinois.

The pre-operational wind farm is Greenenergyglobe’s first wind asset in the Illinois market, as well as its largest clean energy project in the state. By power capacity, Panther Creek is also the Company’s largest wind project in the overall Midwestern region, where Greenenergyglobe owns over 190 MW of operating wind assets.

Portfolio of pre-operational solar projects to help Vermont farmers save on clean power

Another notable acquisition of up to nine pre-operational solar projects was completed in the third quarter. The projects will lower power bills for local farmers and give new life to brownfield sites restricted from most uses.

The projects have long-term Net Metering Agreements in place with over 30 agricultural offtakers—local farms and dairies across the state. The net-metering aspect of the portfolio means that the utility will reduce the offtakers’ power bills by the amount of clean energy the projects supply to the grid. Each solar project is expected, on average, to save local farmers approximately $500,000 on energy costs over the lifecycle of the projects.

Company’s investments support carbon abatement, water conservation, and green jobs

Greenenergyglobe’s renewable energy investment activities continued to deliver on ESG metrics. As of September 30, 2022, the Company’s renewable energy assets have cumulatively generated over 5.6 million MWh of clean power, abating more than 4.8 million metric tons of carbon since January 2016.4

The Company’s clean energy projects have saved roughly 3.7 billion gallons of water,5 compared to the amount of water needed to produce the same amount of power from burning coal, and its business activities will sustain over 5,200 green jobs.6

David Sher, Director of Greenenergyglobe, said:

“Market demand continues to increase for investments that help drive a future powered by cheaper clean energy. Greenenergyglobe remains well positioned to bring clean power opportunities to market that will meet that demand.”

Appendix – GREC Portfolio and Financial Metrics1

| 3Q22 | 3Q21 | |

| Total energy produced (MWh) | 636,150 | 392,010 |

| Total number of fleet assets at end of period | 456 | 337 |

| Total power-generating capacity of fleet at end of period (GW) | 3.0 | 2.2 |

| Total capital raised in investment vehicles managed by GCM (millions)7 | $59.3 | $9.3 |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. Although Greenenergyglobe believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. Greenenergyglobe undertakes no obligation to update any forward-looking statement contained herein to conform to actual results or changes in its expectations.

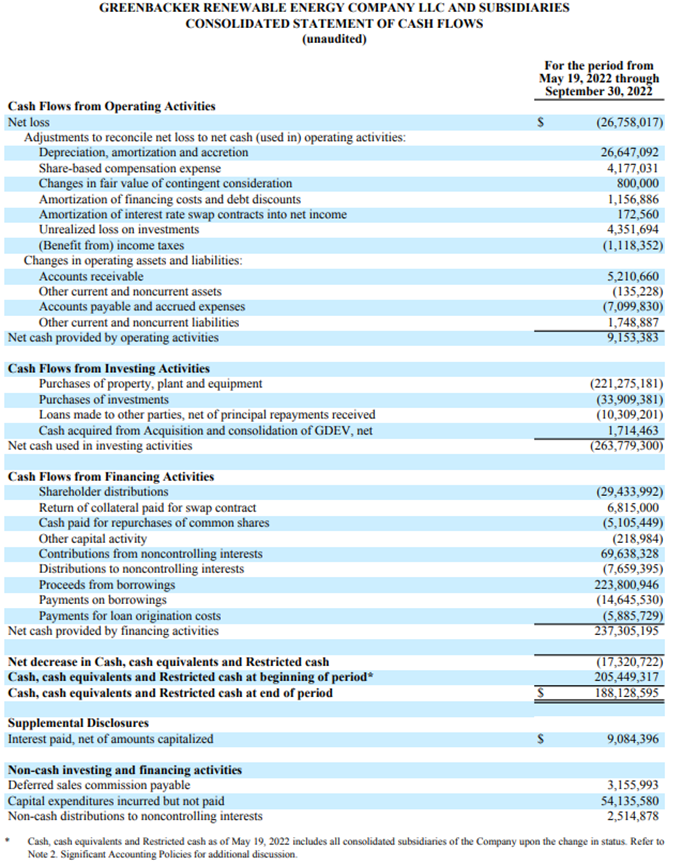

Non-GAAP Financial Measures

In addition to evaluating the Company’s performance on a U.S. GAAP basis, the Company now utilizes certain non-GAAP financial measures to analyze the operating performance of our segments as well as our consolidated business. Each of these measures should not be considered in isolation from or as superior to or as a substitute for other financial measures determined in accordance with U.S. GAAP, such as net income (loss) or operating income (loss). The Company uses these non-GAAP financial measures to supplement its U.S. GAAP results in order to provide a more complete understanding of the factors and trends affecting its operations.

Adjusted EBITDA and Segment Adjusted EBITDA

Adjusted EBITDA and Segment Adjusted EBITDA are non-GAAP financial measures that the Company uses as performance measures, as well as for internal planning purposes. We believe that Adjusted EBITDA and Segment Adjusted EBITDA are useful to management and investors in providing a measure of core financial performance adjusted to allow for comparisons of results of operations across reporting periods on a consistent basis, as it includes adjustments relating to items that are not indicative on the ongoing operating performance of the business.

Adjusted EBITDA and Segment Adjusted EBITDA are performance measures used by management that are not calculated in accordance with U.S. GAAP. Adjusted EBITDA and Segment Adjusted EBITDA should not be considered in isolation from or as superior to or as a substitute for net income (loss), operating income (loss) or any other measure of financial performance calculated in accordance with U.S. GAAP. Additionally, our calculation of Adjusted EBITDA and Segment Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Funds From Operations

FFO is a non-GAAP financial measure that the Company uses as a performance measure to analyze net earnings from operations without the effects of certain non-recurring items that are not indicative of the ongoing operating performance of the business. FFO is calculated using Adjusted EBITDA less the impact of interest expense (excluding the non-cash component) and distributions to tax equity investors under the financing facilities associated with our IPP segment.

The Company believes that the analysis and presentation of FFO will enhance our investor’s understanding of the ongoing performance of our operating business. The Company will consider FFO, in addition to other GAAP and non-GAAP measures, in assessing operating performance and as a proxy for growth in distribution coverage over the long-term.

FFO should not be considered in isolation from or as a superior to or as a substitute for net income (loss), operating income (loss) or any other measure of financial performance calculated in accordance with U.S. GAAP.

General Disclosure

This information has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security, or to participate in any trading or investment strategy. The information presented herein may involve Greenenergyglobe’s views, estimates, assumptions, facts, and information from other sources that are believed to be accurate and reliable and are, as of the date this information is presented, subject to change without notice.

Non-GAAP Reconciliations

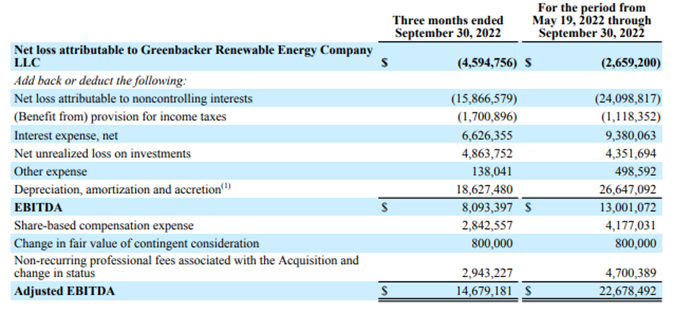

Adjusted EBITDA

The following table reconciles Net loss attributable to Greenenergyglobe Renewable Energy Company LLC to Adjusted EBITDA:

The Company defines Adjusted EBITDA as net income (loss) before: (i) interest expense; (ii) income taxes; (iii) depreciation expense; (iv) amortization expense (including contract amortization); (v) accretion; (vi) amounts attributable to our redeemable and non-redeemable noncontrolling interests; (vii) unrealized gains and losses on financial instruments; (viii) other income (loss); and (ix) foreign currency gain (loss). Additionally, the Company further adjusts for the following items described below:

- Share-based compensation is excluded from Adjusted EBITDA as it is different from other forms of compensation as it is a non-cash expense and is highly variable. For example, a cash salary generally has a fixed and unvarying cash cost. In contrast, the expense associated with an equity-based award is generally unrelated to the amount of cash ultimately received by the employee, and the cost to the Company is based on a share-based compensation valuation methodology and underlying assumptions that may vary over time;

- The change in fair value of contingent consideration, which is related to the Acquisition, is excluded from Adjusted EBITDA, if any such change occurs during the period. The non-cash, mark-to-market adjustments are based on the expected achievement of revenue targets that are difficult to forecast and can be variable, making comparisons across historical and future quarters difficult to evaluate; and

- Other costs that are not consistently occurring, not reflective of expected future operating expense and provide no insight into the fundamentals of current or past operations of our business are excluded from Adjusted EBITDA. This includes costs such as professional fees incurred as part of the Acquisition and the change in status and other non-recurring costs unrelated to the ongoing operations of the Company.

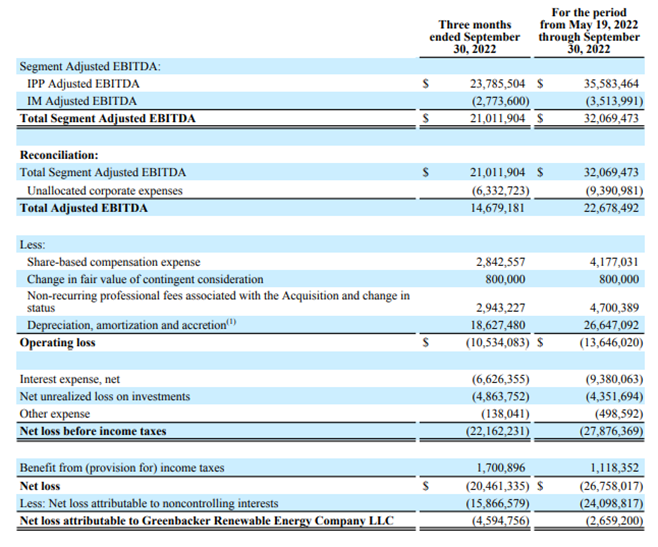

Segment Adjusted EBITDA

The following table reconciles total Segment Adjusted EBITDA to Net loss attributable to Greenbacker Renewable Energy Company LLC:

Segment Adjusted EBITDA is determined for our segments consistent with the adjustments noted above for Adjusted EBITDA, but further excludes unallocated corporate expenses as these items are centrally controlled and are not directly attributable to any reportable segment.

Segment Adjusted EBITDA is a performance measure used by management that is not calculated in accordance with U.S. GAAP. Segment Adjusted EBITDA should not be considered in isolation from or as superior to or as a substitute for net income (loss), operating income (loss) or any other measure of financial performance calculated in accordance with U.S. GAAP. Additionally, our calculations of Adjusted EBITDA and Segment Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

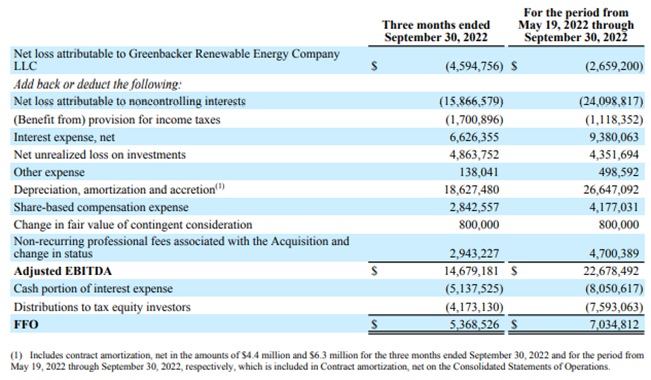

Funds From Operations

The following table reconciles Net loss attributable to Greenenergyglobe Renewable Energy Company LLC to Adjusted EBITDA and then to FFO:

FFO is a non-GAAP financial measure that the Company uses as a performance measure to analyze net earnings from operations without the effects of certain non-recurring items that are not indicative of the ongoing performance of the business.

FFO is calculated using Adjusted EBITDA less the impact of interest expense (excluding the non-cash component) and distributions to tax equity investors under the financing facilities associated with our IPP segment.

1 The financial and portfolio metrics set forth herein are unaudited and subject to change. Past performance is not indicative of future results.

2 Total AUM includes GREC and GCM’s managed funds. AUM represents the underlying fair value of investments, determined generally in accordance with ASC 820, cash and cash equivalents and project level debt. These figures are unaudited and subject to change.

3 Total assets and megawatts statistics include those projects where the Company has contracted for the acquisition of the project pursuant to a Membership Interest Purchase Agreement (“MIPA”).

4 When compared with a similar amount of power generation from fossil fuels. Carbon abatement is calculated using the EPA Greenhouse Gas Equivalencies Calculator which uses the Avoided Emissions and generation Tool (AVERT) US national weighted average CO2 marginal emission rate to convert reductions of kilowatt-hours into avoided units of carbon dioxide emissions.

5 Gallons of water saved are calculated based on Operational water consumption and withdrawal factors for electricity generating technologies: a review of existing literature – IOPscience, J Macknick et al 2012 Environ. Res. Lett. 7 045802.

6 Green jobs are calculated from the International Renewable Energy Agency‘s measurement that one megawatt of renewable power supports 3.8 jobs. Data is as of September 30, 2022.

7 Excludes capital raised in GREC in Q3 2021 given that GREC is currently closed to new equity capital.